Also, you're letting sellers understand you're a major and competent buyer. Typically, if there's competitors for a home, purchasers who have their financing in place are preferred since it reveals the seller you can manage the house and are prepared to purchase. We'll likewise go through the pre-approval procedure a bit more in the next section. You organize Go to this site to repay that money, plus interest, over a set time period (referred to as a term), which can be as long as thirty years. To make sure that you pay back the cash you obtained, you put your house up as collateralso if you stop making payments, the bank can take your home away from you in a procedure called a foreclosure.

If you secure a mortgage that isn't right for you, causing foreclosure, you'll not only need to moveand in general wait between 3 and 7 years before you are allowed to buy another homebut your credit rating will likewise suffer, and you might be hit with a big tax expense.

That's where we can be found in. The companies that supply you with the funds that you require are described as "lenders." Lenders can be banks or home mortgage brokers, who have access to both big banks and other loan lenders, like pension funds. In 2012, the greatest loan providers in the nation consisted of Wells Fargo, Chase and Bank of America.

You desire to ensure that whoever you work with directly has a track record for being dependable and efficient, since any hold-ups or problems https://penzu.com/p/806964eb with closing on a sale will only cost you more money. Government loans are available through the Federal Housing Administration, but the accessibility of loans varies depending upon where you live.

The Ultimate Guide To What Are Interest Rates For Mortgages

Home loan lending institutions do not lend hundreds of countless dollars to just anyone, which is why it's so important to maintain your credit score. That score is among the primary ways that lenders examine you as a trusted borrowerthat is, someone who's most likely to pay back the money in complete.

Some lenders might decline your application if you have a lower credit rating, but there isn't a universal cutoff number for everybody. Instead, a lower credit report implies that you might read more end up with a higher rates of interest. A charge you might see enforced by a lending institution is one for "points." These upfront charges (they generally exercise to be about 1% of the loan amount) are typically a kind of pre-paid interest.

Points are paid at closing, so if you're trying to keep your upfront expenses as low as possible, choose a zero-point option. With a home loan, you'll pay the principal, interest, taxes and insuranceall of which are frequently referred to as PITI. Keep in mind that unless you are a high-risk customer, you can select to pay taxes and insurance individually from your home mortgage, which will offer you a lower mortgage payment.

Here's how each element of PITI works: This is the initial amount that you obtained to pay your mortgage (what are today's interest rates on mortgages). The bank decides how much it will provide you based on elements like earnings, credit and the amount you plan to provide for a deposit. If your deposit is less than 20% of the home's price, the bank may consider you to be a riskier lending institution and either charge you a higher interest rate or require that you purchase personal home loan insurance, typically referred to as PMI.

The Best Guide To How Are Adjustable Rate Mortgages Calculated

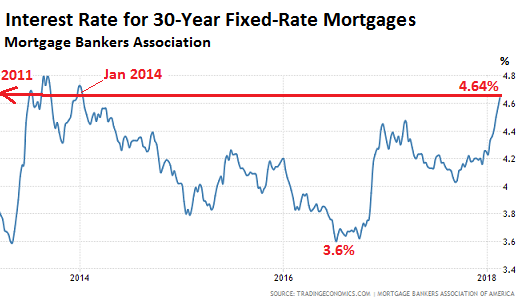

When you get a mortgage, you consent to a rates of interest, which will determine just how much you pay a lending institution to keep lending. It's revealed as a portion: 5% to 6% is thought about rather standard, but the rates depend highly on a person's situationincome, creditas examined by the lending institution.

Home taxes approach supporting city, school district, county and/or state infrastructure, and you can pay them together with your mortgage. They're revealed as a percentage of your home value, so you can approximately approximate what you'll pay by searching public records for the real estate tax for neighboring homes of comparable value.

Any payments scheduled for homeowner's insurance to safeguard against fire, theft or other disasters are likewise held in an escrow account. (Again, this is something that you can opt out of escrowing, unless you're a high-risk debtor.) If you're a high-risk borroweror if you do not have the 20% down paymentyou're likewise required to have private home mortgage insurance (PMI), which helps ensure that the loan provider will get cash back if you can't pay it for any reason.

Bear in mind that PMI is meant to safeguard the loan provider, not the borrowerso it will not bail you out if you default on your payments. Home loans are structured so that the proportion of your payment that approaches your principal shifts as the years pass. In the beginning, you're paying mostly interest; eventually, you'll pay mostly primary.

The Ultimate Guide To What To Know About Mortgages In Canada

There are a few various kinds of typical home mortgages: This is the most popular payment setup for a home mortgage - why do mortgage companies sell mortgages. It suggests that the borrower will pay a "fixed" rates of interest for the next 30 years. It's an enticing prospect due to the fact that property owners will pay the exact very same amount monthly. Fixed home loans are best for property buyers who purchase when interest rates are low or rising, are relying on a predictable payment and who prepare to remain in the house for a long time.

These are best for property owners who wish to pay off their home loans and construct equity quickly. Rates of interest for 15-year fixed home loans normally likewise carry lower interest rates than 30-year home loans. The rates of interest on adjustable rate mortgages are changed at established periods to show the existing market. Some mortgages are a combination of fixed and adjustable: for the very first three, 5 or 7 years, the rate will stay fixed, and then be changed every year for the period of the loan.

This kind of loan might be best for you if you plan to live in your home for approximately the same length of time as the initial fixed term. Keep in mind Long prior to you actually get a mortgage, you can start constructing your credibility by developing great credit, and building up cost savings for a deposit.

A home loan is a loan gotten to buy property or land. Most run for 25 years however the term can be shorter or longer. The loan is 'protected' against the value of your house up until it's paid off. If you can't keep up your payments the lending institution can reclaim (reclaim) your home and sell it so they get their refund.

5 Simple Techniques For How Do Interest Rates Affect Mortgages

Likewise, think of the running costs of owning a house such as home costs, council tax, insurance and upkeep. Lenders will wish to see evidence of your earnings and particular expense, and if you have any debts. They may ask for info about household expenses, child upkeep and individual expenses.